So I guess, we all know what the deal is here. Especially, if someone is a foodie like me ❤ All of us who regularly go to food joints and restaurants to have some yummy food have an idea about the extra charges that are applied to the total bill apart from the actual food charges. Well, we got to know this, don’t we? I am sure nobody here would like an embarrassing situation of having less cash or credit on hand 😉

So I guess, we all know what the deal is here. Especially, if someone is a foodie like me ❤ All of us who regularly go to food joints and restaurants to have some yummy food have an idea about the extra charges that are applied to the total bill apart from the actual food charges. Well, we got to know this, don’t we? I am sure nobody here would like an embarrassing situation of having less cash or credit on hand 😉

Apart from the issue of being ready for the expenses, there is also the concern of restaurants cheating us due to our inadequate knowledge. We as customers don’t actually sit down to calculate the extra charges, in an effort to avoid an unpleasant situation, but having basic knowledge about it ensures that nobody can cheat the daylights out of you, that’s for sure.

The real reason why I became interested in this topic was however different! Since we are students, my friends and I usually contribute equally while eating out or in rare cases, we pay in accordance to who eats what. So naturally you can understand it’s quite a headache to calculate everyone’s share in the second case, specially where taxes are involved!

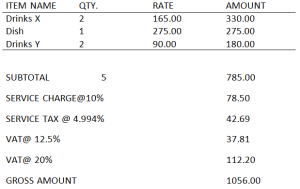

So here is the bill which really gave my grey cells a run for their money:

Okay I know what you guys are thinking. Why not just divide the bill in two parts, young lady? Why go to such lengths for the trouble of calculating? See, the difficulty here is that I actually had one Drinks X and two Drinks Y. Hey, you can’t blame a girl for being thirsty, can you? 😛 So obviously my share was so much more than my friend.

Therefore , I had to understand the basic structure of the bill in order to calculate my share. So here goes!

Okay so there are basically four types of charges and taxes which are levied:

- Food Charges

- Service charges

- Service tax

- Value added tax

FOOD CHARGES:

These are the actual charges of the food and drinks that we have ordered. These are the prices that are indicated on the menu. eg in this case the food charge of the dish is Rs 275.

SERVICE CHARGES:

These are the charges that we have to pay the restaurant for its services. There is no tax guidelines for it. Basically it can be considered equivalent to giving tips to the waiter. It’s usually below 10%. An important thing is that these charges should be mentioned on the menu, otherwise you can question their inclusion in the bill.

So don’t feel obligated to give further tips to the waiter if you have already paid the service charge. No fun in paying double!

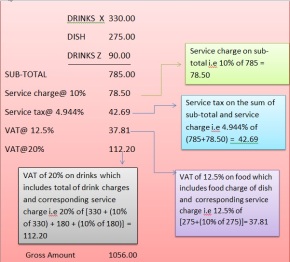

SERVICE TAX:

Service tax is the tax levied by the government on the services rendered by restaurants. Since it’s difficult to ascertain taxes on services rendered based on the amount of food we have ordered, hence there is an abatement of about 60% on the tax. Hence the total tax is 12.36% which is levied on 40% of bill which includes your food, drink and the service charge. For shortcut, 12.36% x 40% = 4.944% is what is usually denoted in the bill as service tax. This is same in all states. The restaurant must be air-conditioned for service tax.

VALUE ADDED TAX:

This is a form of consumption tax which is state specific. Can be low as 5% or as high as 20%. Additionally, it’s different for food and drinks. For the state of Delhi, it is 12.50% for food and 20% for drinks.

Well there, I hope this post will have explained atleast some doubts which you might have regarding this topic!

I needed to thank you for this excellent read!! I absolutely loved every little bit of it. I have you book-marked to check out new things you post…

LikeLike

Thank you for such a wonderful comment 🙂

LikeLike